Hot Budgets & Tax Preparation How-Tos

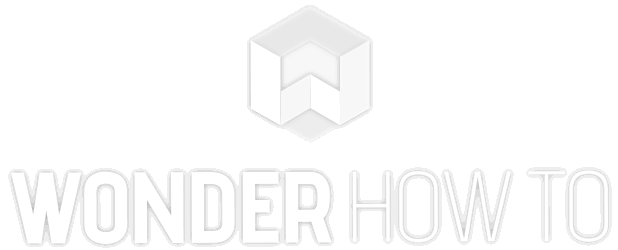

How To: Write a check

Here are step-by-step instructions on how to write a check. 1. Date the check, and ensure it is dated for the day you intend the recipient to cash it.

How To: Get easy free samples & coupons by mail and save

In this clip, learn how to get amazing amounts of goodies in the mail for free! Kitty, the coupon diva, will show you how to request things like free samples and manufacturer coupons from companies so you can stock pile them and save. Get extra freebies every time you open up your mailbox with these awesome tips.

How To: Start a retirement plan for your small business employees

If you're looking to start a retirement plan for your employees, this how to from the IRS is a great, informative video. Everyone knows that keeping great employees is essential to staying competitive and growing in today's business world. Find out how to start a retirement plan to keep those great workers right there where they are.

How To: Get back on track if you haven't filed a tax return in years

If you haven't filed a tax return in the past few years, you can go to the IRS to help you with filing past taxes and get you back on track. Find out in this video how you can get all caught up with your taxes.

How To: Avoid the top dozen tax scams

Every year, many people fall victim to scammers trying to dupe taxpayers out of their hard-earned money. The IRS compiles an annual list of the twelve most popular tax scams perpetrated on the public. Check out this video to learn out about the top tax scams to avoid.

How To: Get the right paperwork for charitable donations

If you've made any donations to charity this year, there are several important rules about deducting charitable contributions on your tax return. Most importantly, the correct paperwork is needed to document the transaction for the deduction. Find out in this informative video from IRS.gov.

How To: File Your 2010 Federal Income Tax Return (IRS Tax Tips for Individuals & Businesses)

It's mid-January and some of you happy tax-paying citizens have already started receiving your W-4s and 1099s in the mail. But before you start filling out your 2010 Federal Tax Return, make sure you're hip to all the tax tricks in 2011. You could end up saving some money!

How To: Consolidate debt with a 0% APR credit card and low APR bank loan

Are you under a backbreaking amount of debt? In this economy, we don't blame you. If credit card bills, mortgages, and bank loans are making you want to crawl into bed and pull the covers over your face, then check out this video to learn how to consolidate debt.

How To: File a Last-Minute 2010 Income Tax Return: Save Money, Get Free Tax Help & More!

Ever since high school, I've been preparing my own taxes. Each year it gets more and more complicated, which results in me filing later and later, avoiding it until I have the time or just can't wait any longer. I even resorted to using TurboTax online to help do some of the grunt work for me these past couple years, but that hasn't stopped me from being lazy about it. I have yet to file my 2010 taxes, but I will very soon. Tomorrow, in fact—before TurboTax raises their prices.

How To: Use the IRS Online Payment Agreement system

If you've set up a way with the IRS to pay off your taxes, you may want to consider signing up for the new Online Payment Agreement. This simple method lets you pay from your home computer and you can even set up direct debit for even more convenience.

How To: File an amended tax return (Form 1040-X)

If you think you may have goofed on your tax return, you're going to want to file a 1040-X, which is an amended tax return. This quick video by the IRS shows how to do it, for this, or any of the previous 3 years.

How To: Apply for California food stamps

In this tutorial, we learn how to apply for California food stamps. First, to go the website: California Food Stamps. After you are on this site, you will see a pop up where you can enter in your name and e-mail, as well as more information about food stamps in California. After you enter in your information, you will receive an e-mail with two links on it. One will be for the application and the other will be to find an office near you. Print out the application and fill it out entirely, fol...

How To: Apply for Arizona food stamps

In this video, we learn how to apply for Arizona food stamps. First, you will need to go online and print out the application to receive food stamps from the state. You will also need to print out the information that you will need to bring with you as well as look for an office that is closest to your location. Fill out all of the sections of the application until it's complete. Make sure to use the correct colored pen and don't leave out any information. If you do leave something out, this ...

How To: Use the IRS tax deduction calculator

Getting ready to file your taxes? Good, but you're not sure how much you're going to be expecting in a refund? Need to calculate your deductions still? No worries. In this video you will learn how to use the IRS tax deduction calculator to figure out how many deductions you qualify for and what your refund will end up being.

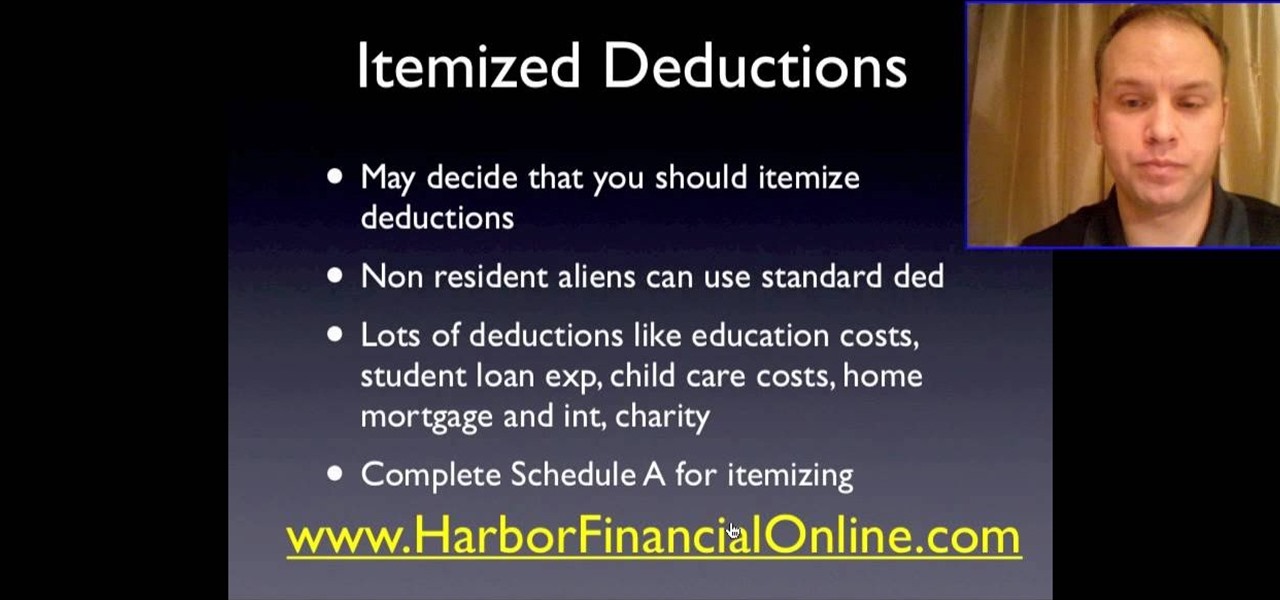

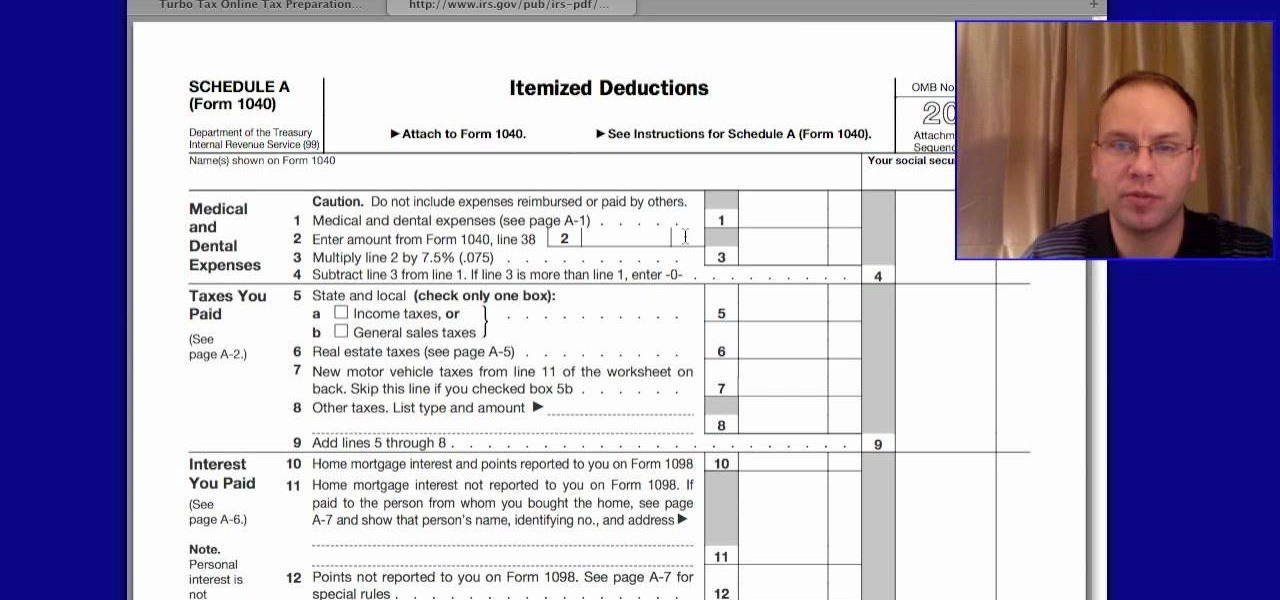

How To: Fill out schedule A deductions of the federal 1040

The world of taxes and filling out the 1040 form itself is pretty confusing, especially if you're unsure about the terms, "deductions" and "credits". In this video you will get a full walkthrough of how tax deductions work and how to fill out the Schedule A portion of the 1040 form for your federal income taxes.

How To: Fill out the child tax credit worksheet

If you have children who are still your dependents and have been living in your household for at least half of the year, and have their own social security number, you can actually get a major tax credit with a simple worksheet. In this video you will learn the requirements for the tax credit and also how to fill out the worksheet and calculate your credit.

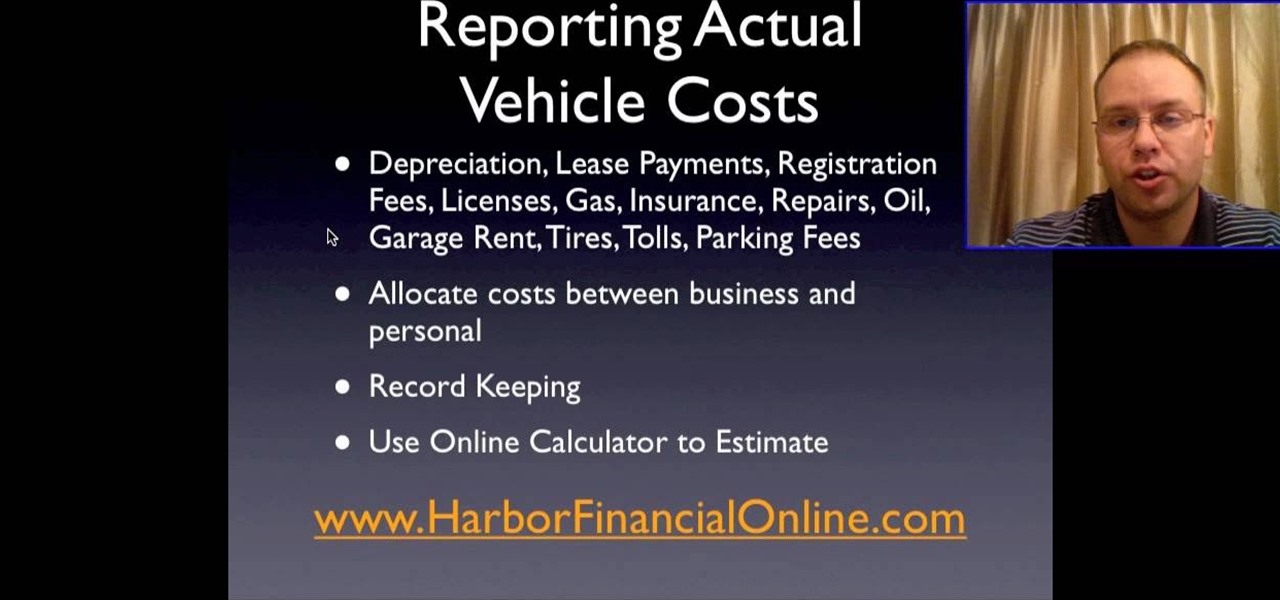

How To: Report standard mileage rates vs actual vehicle expenses tax

If you're driving a commercial vehicle or doing a lot of driving for a company, there are ways to claim deductions on your tax return for actual vehicle expenses. In this video you will learn how to calculate your standard mileage rates to determine how much you will be getting on your tax refund if your employer is not reimbursing you for gas or if you're running a small business.

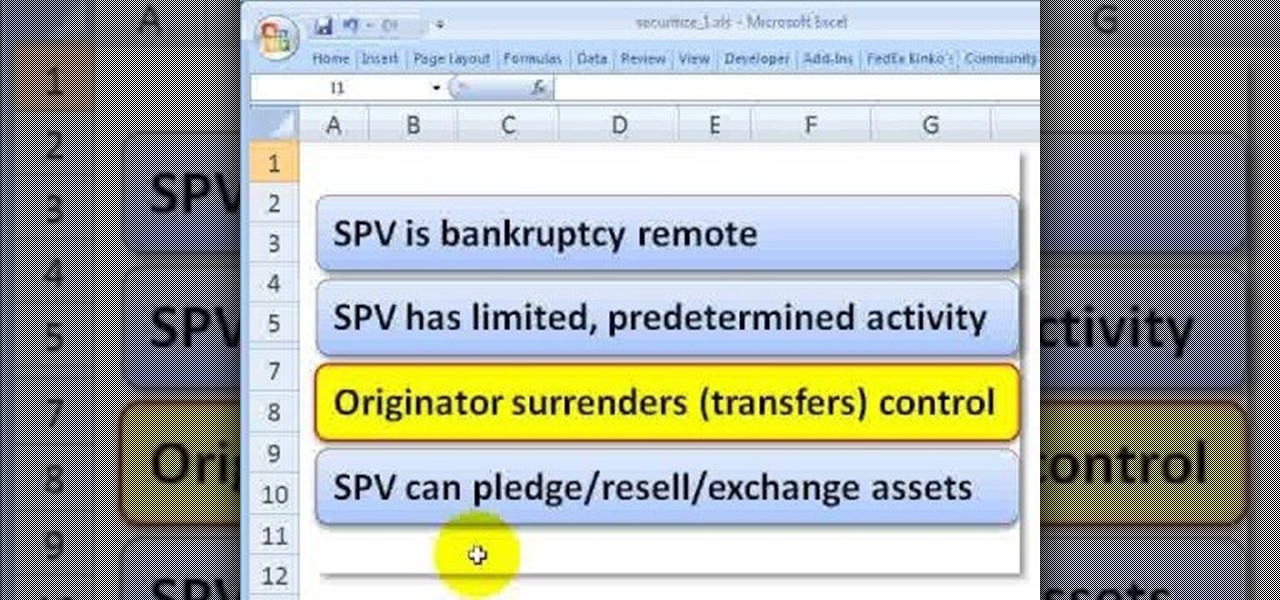

How To: Understand a securitization

In this tutorial, we learn how to understand a securitization. This is a type of structured finance that has three key elements. the first is that there is a pooling of credit sensitive assets. In pooling the assets, you introduce diversification. The second element is to transfer credit risk to the third party and make rules around whether there has been a true transfer of credit risk. The third element in this is trenching of liabilities. This means when cash flows are transferred to a spec...

How To: Apply for and receive a credit card

Bad credit? No credit? A good way to improve your personal credit score is by getting and maintaining a credit card. Get your first credit card and learn the basics of credit finance.

How To: Improve your FICO credit score

In this tutorial, we learn how to improve your FICO credit score. Everyone will want to use your credit score to decide what kind of person you are. The FICO is the most commonly used credit score used today. To improve your credit score you will want to make all payments on time. Catch up on past due accounts and utilize 50% and less of your credit limit. Your balance should be under half of what your limit is. Don't close your account, because this can drop your credit score as well. Revolv...

How To: Conduct a wire transfer

Has you rent check bounced again for no apparent reason? It happens to everyone, but if you're roommate needs the money fast, you need to fix it fast, and wire transfers are the fastest way to give money to someone else. Executing a wire transfer is as easy as making one phone call.

How To: Get credit when you have no credit

In this video, we learn how to get credit when you don't have any. Most credit agencies are now gathering information about younger people to figure out if they are allowed to get credit cards, which will help them build a credit score. There is a website, PRBC, where you can start a file and enter your information, and it can verify all the information you report. This information will be given to credit reporting agencies, and give you more of a chance to get credit. Next, you can get depar...

How To: Deal with a traffic ticket & not raise your insurance

In this video tutorial, viewers learn how to deal with a traffic ticket. When you pay for a ticket, don't just ignore it because there is always a hidden cost to a speeding ticket. Speeding tickets may cause insurance rates to go up. To avoid the insurance penalty, users should either go to court or traffic school. Going to traffic school to take the ticket off of your driving record. Another method is to cut a deal with the prosecutor. The key is to keep the points off your record and not al...

How To: Save money on food with CVS coupon match ups

This penny pincher's guide offers advice on how to take advantage of CVS coupon match ups to score free and near-free goods from CVS. While such savings require a little bit of legwork, the underyling process is simple enough that this tutorial can present an overview of it in just over six and a half minutes.

How To: Shop for free at CVS by using the right coupons

In this clip, Kitty the Coupon Diva will show you how to maximize your coupons and extra care bucks so that you can walk out of CVS with a cart full of groceries for free! Kitty will show you how to use circular flyers, bag tags, extra care bucks, coupons and rebates to walk in and out of the drug store without spending any money. Try these tricks the next time you shop and save a ton of money.

How To: Read coupon abbreviations & acronyms & shop smarter

In this clip, Kitty the Coupon Divas will teach you how to better understand common abbreviations and acronyms that pop up on coupons. Make sure you know what you're using when you shop in order to maximize your savings and get tons of free goodies.

How To: Get extra rebates and "try me free" shopping offers

In this clip from Kitty the Coupon Diva, learn how to find and use rebates in any store: supermarkets, drug stores.. anywhere! Get tons of freebies from product companies simply by shopping smarter. Kitty will also show you how to find these offers online after you have made your purchases for increased savings.

How To: Set up a coupon binder and shop like an organized pro

Have you ever gotten to the checkout at the supermarket and dropped your coupons all over the floor? If you are learning how to be a coupon diva, you are going to be carrying hundreds of coupons. In this clip, learn how to make a perfect coupon binder so that you are organized and neat, and can approach the supermarket prepared to save. This easy fix is explained in detail in this clip so you can get started.

How To: Save money on health care

These days, everyone is trying to save money wherever possible. Health care is often one of our biggest expenses and in this tutorial, you will get some expert tips on how to lower your expenses and save money on health care.

How To: Read a balance sheet in accounting

In this Business & Money video tutorial you will learn how to read a balance sheet in accounting. Yu can learn to read it quickly and easily as to where the company’s came from, where it went and where it is now. There are four main financial statements; balance sheets, income statements, cash flow statements and statements of shareholder equity. In the balance sheet, under assets are listed things that the company owns that have value. Liabilities are amounts of money company owes to other...

How To: Effectively negotiate with your credit card company

In this video tutorial, viewers learn how to negotiate with a credit card company. There are 3 main items that users can negotiate. The first item is the date of payment. Users are able arrange a more convenient date for payment. The second item is the annual fee. Users are able to work out a way to not have to pay an annual fee for using a credit card, which will help save money. The third item is the interest rate. Users can negotiate and try to lower the interest rate that they must pay. T...

How To: Raise your credit score quickly with Linda Ferrari

Raise your credit score in five simple steps? Sounds too good to be true, doesn't it? Well, financial expert Linda Ferrari is here to to explain to you how this is possible. In these rough economic times, everyone could use a little boost, so why not take some of Linda's advice and give your score some help?

How To: Improve your credit score, even in a recession

Now more than ever, people everywhere are suffering from bad credit. Credit is important. You need it to take out loans, buy a house, rent an apartment, get a car, almost anything! Check out this two part video, presented by Daniel Medina from United Credit Education Services, and listen along as he offers you tips on how to improve your credit - even in a recession. This helpful and informative video can start you on the right track to financial stability, no matter what the circumstances.

How To: Open and manage your first bank account

Your first bank account can be exciting and confusing at the same time. Check out this video and learn how to manage your money and accounts so you don't wind up in the red. You don't have to earn an MBA to make good financial decisions; this video offers plenty of suggestions to keep your accounts on track.

How To: Tell a loved one "no" when they ask for a loan

When someone you love asks for money it can be very hard to turn them down; especially since you are usually put on the spot. Check out this tutorial and discover ways that you can help your friend without having to spend a dime, and make things easier for everyone.

How To: Get a PayPal account

If you like to shop online then it is extremely helpful to have a PayPal account to safely make your online purchases. Help reduce your risk of identity theft by using protected methods like PayPal when your credit card information is involved.

How To: Write checks in Intuit QuickBooks

If you've ever wanted to know how to write checks in Intuit QuickBooks program, this instructional is for you. To write a check in the QuickBooks program: Select banking from the menu bar, and then the write checks command. Select the checking account for which the checks will be drawn from the checking accounts drop down menu. Assign the check a number if you will be printing the check. If you are printing the check, make sure that the "to be printed" box is checked. Enter the correct date f...

How To: Save more money in your daily life

This is video is a tutorial on how to save more money in your daily life. The video says that budget professional suggest that we need to set a goal. Decide why you're saving your money. Save your money to where if there were an emergency you could comfortably use your savings. The video suggests taking advantage of your employer's retirement fund. Last but certainly not least, we are told that saving sooner is better than saving later.

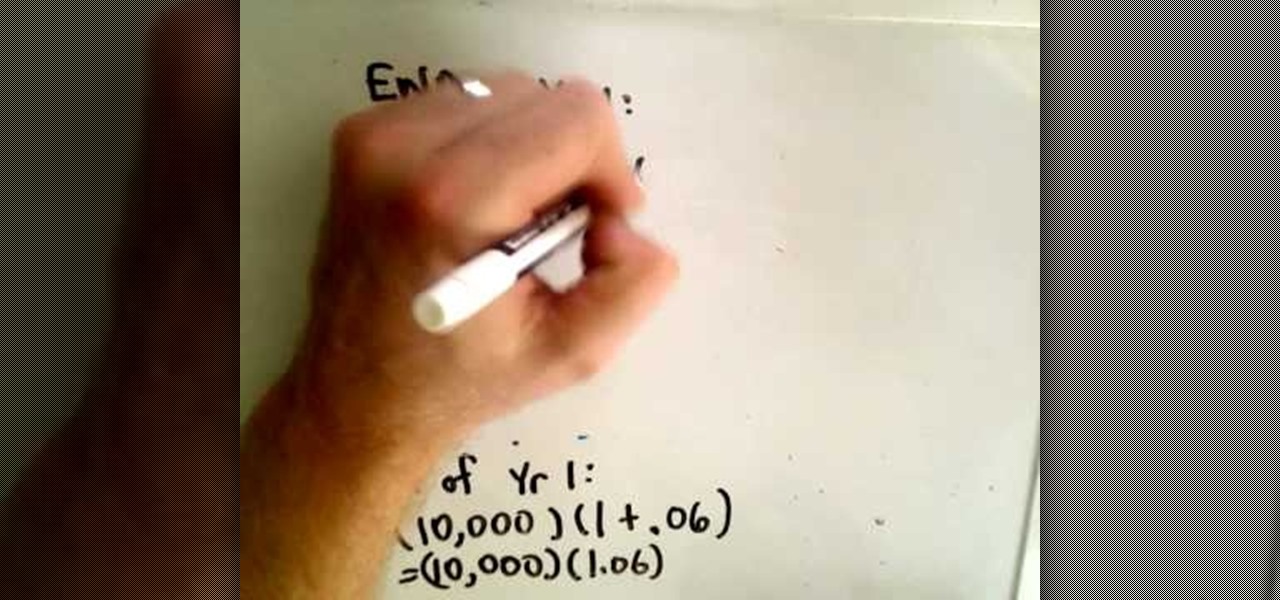

How To: Derive the annual compound interest formula

In this video tutorial the instructor shows how to derive the formula to compute interest compounded annually. He starts with explaining the basic concepts like principle which is the amount you borrow and the rate of interest or annual percentage rate (APR), which is the rate at which you pay the interest up on the borrowed principle. He shows that the amount after the end of one year is amount A = P(1+APR),and he goes on and generalizes how to compute it for n years. This video shows how to...

How To: Use and understand the concept behind MoneyWell

Ever hear of MoneyWell? There's a whole slew of personal budgeting softwares available today, but figuring out which one is right for you is extremely difficult. This video tutorial will help you understand the concepts behind MoneyWell and how easy it is to manage your cash flow.